Simplify your business's transition to e-Invoicing

Our solution enables technical compliance to e-Invoicing requirements and allows your business to focus on aligning processes.

What is e-Invoice?

Digital Transaction

Digital representation of a transaction between a supplier and a buyer.

Instant Validation

Validation of e-Invoice by IRBM is done instantly, ensuring prompt processing and compliance.

Document Replacement

Replaces traditional paper or electronic documents like invoices, credit notes and debit notes.

Data Security

Prevents data changes, improving the security and trust of transactions.

Why QubePos E-Invoice Compliance Solutions?

We simplify your transition to e-Invoicing by ensuring technical compliance with all requirements. Our solution streamlines the process, allowing your business to focus on optimizing operations rather than navigating complex regulations.

LHDN Compliance

Effortlessly meet LHDN requirements with our built-in compliance features, ensuring your invoicing practices are always up-to-date.

Seamless Integration

Manage sales and e-invoices seamlessly within one powerful POS system, streamlining your operations and saving valuable time.

Enhanced Security

Protect your financial data with top-tier encryption and secure invoicing protocols, providing peace of mind and safeguarding your business.

Schedule a free demo.

We are happy to hear from you!

Features and Capabilities of Qube e-Invoicing Platform

Our e-invoice platform is a constantly updated solution, adaptable to legal changes, ensuring continuous usability.

Compliance Ready

Easily meet Malaysia's e-invoicing mandates with our fully compliant solutions.

Real-time Insights

Get instant visibility into invoicing activity, track payments, and make decisions.

Automated Workflows

Generate and process invoices automatically, saving you time, money, and headaches.

Notification Alerts

Receive automated notifications and alerts through your network feed promptly.

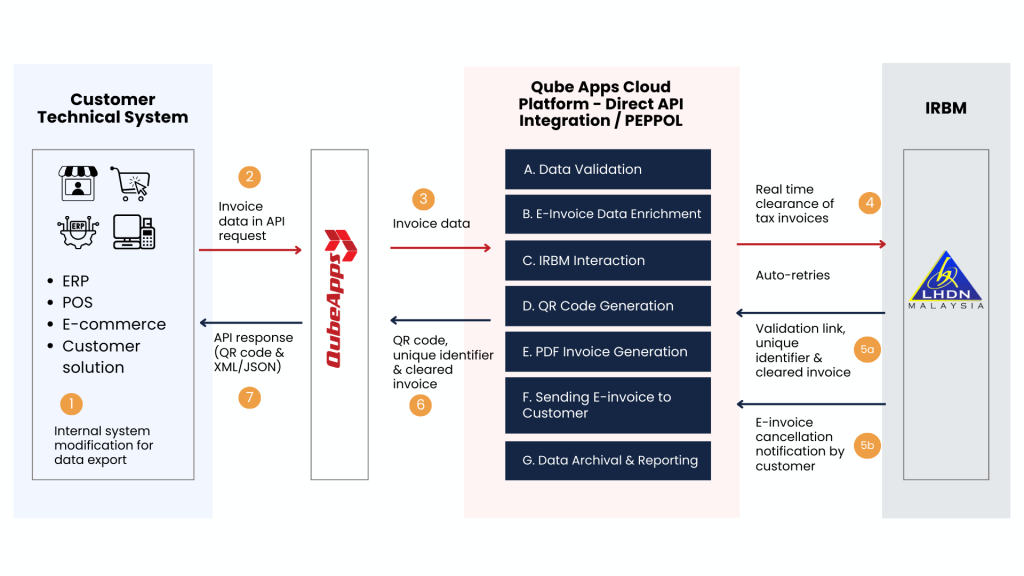

Single Window Middleware

Integrate multi-source systems seamlessly with single window middleware.

Validation of Sources Data

Map and validate source data accurately to ensure conformity with LHDN standards.

Our E-invoicing Solution Components

Frequently Asked Questions (FAQs)

What is an e-invoice?

A digital representation of a transaction between a supplier and a buyer, formatted for automatic electronic processing by related systems.

What transactions are covered under e-invoicing?

E-invoicing in Malaysia covers Business to Business (B2B), Business to Customer (B2C), and Business to Government (B2G) transactions.

When should businesses start generating e-invoices?

E-invoicing will be mandatory for businesses with an annual turnover exceeding RM100 million starting from 1 August 2024. The requirement will extend to businesses with turnover between RM25 million and RM100 million from 1 January 2025.

What is the MyInvois System?

The MyInvois System is part of the e-invoicing initiative in Malaysia, designed to support the creation, submission, and validation of e-invoices. The system aims to enhance efficiency and compliance with tax regulations.

Can e-invoices be cancelled or edited once submitted?

E-invoices can be cancelled within 72 hours of generation. However, they cannot be edited once validated; a new e-invoice must be issued instead.

What should be considered for foreign currency?

For transactions in foreign currencies, businesses are required to convert the amounts to Malaysian Ringgit (RM) when issuing e-invoices.

What should businesses do to prepare for e-invoicing?

Businesses are encouraged to familiarize themselves with the new guidelines and integrate their invoicing systems with the MyInvois platform. You may need to consult with their software providers to ensure compatibility and compliance.

Where can businesses find more information or get help?

Businesses can access detailed FAQs and guidelines directly from the IRBM’s official website or contact the IRBM for personalized assistance and clarification.